|

|

|

|

|

|

|

|

|

Status

|

|

|

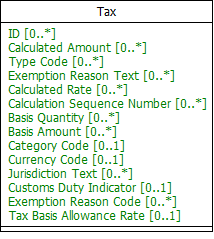

Tax. Identification. Identifier |

|

O

|

|

|

Restricted codes |

All codes |

|

A unique identifier for this tax. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value resulting from the calculation of a tax. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A code specifying a type of tax, such as a code for a Value Added Tax (VAT) [Reference United Nations Code List (UNCL) 5153]. |

|

|

|

Tax. Exemption Reason. Text |

|

O

|

|

|

Restricted codes |

All codes |

|

A reason, expressed as text, for exemption from the tax. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A rate used to calculate the tax amount. |

|

|

|

Tax. Calculation Sequence. Numeric |

|

O

|

|

|

Restricted codes |

All codes |

|

A numeric expression of the sequence in which the tax is to be or has been applied when multiple taxes are applicable per calculation such as first "Value Added Tax (VAT)", second "Transfer". |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A quantity used as the principal component in calculating a tax amount. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value used as the basis in calculating the tax amount. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the category to which the tax applies such as codes for "Exempt from Tax", "Standard Rate", "Free Export Item - Tax Not Charged". |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying a currency of the tax. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

A jurisdiction, expressed as text, to which the tax applies. |

|

|

|

Tax. Customs Duty. Indicator |

|

O

|

|

|

Restricted codes |

All codes |

|

The indication of whether or not this tax is a customs duty. |

|

|

|

Tax. Exemption Reason. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

A code specifying a reason for exemption from this tax. |

|

|

|

Tax. Tax Basis Allowance. Rate |

|

O

|

|

|

Restricted codes |

All codes |

|

The rate of the tax basis allowance (deduction or discount) used to calculate the tax. |

|

|