|

|

|

|

|

|

|

|

|

Status

|

|

|

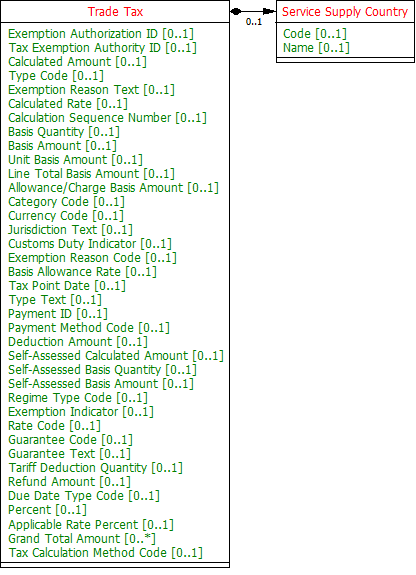

Trade_ Tax. Exemption Authorization_ Identification. Identifier |

|

O

|

|

|

Restricted codes |

All codes |

|

The unique identifier of the exemption authorization for this trade tax. |

|

|

|

Trade_ Tax. Tax Exemption Authority_ Identification. Identifier |

|

O

|

|

|

Restricted codes |

All codes |

|

The unique tax exemption authority identifier for this trade tax. |

|

|

|

Trade_ Tax. Calculated. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value resulting from the calculation of this trade related tax, levy or duty. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the type of trade related tax, levy or duty, such as a code for a Value Added Tax (VAT) [Reference United Nations Code List (UNCL) 5153]. |

|

|

|

Trade_ Tax. Exemption Reason. Text |

|

O

|

|

|

Restricted codes |

All codes |

|

The reason, expressed as text, for exemption from this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Calculated. Rate |

|

O

|

|

|

Restricted codes |

All codes |

|

The rate used to calculate the amount of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Calculation Sequence. Numeric |

|

O

|

|

|

Restricted codes |

All codes |

|

A numeric expression of the sequence in which this trade related tax is to be or has been applied when multiple taxes are applicable per calculation, such as first "Value Added Tax (VAT)", second "Transfer". |

|

|

|

Trade_ Tax. Basis. Quantity |

|

O

|

|

|

Restricted codes |

All codes |

|

The quantity used as the basis for calculating the amount of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Basis. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value used as the basis on which this trade related tax, levy or duty is calculated. |

|

|

|

Trade_ Tax. Unit_ Basis. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value that constitutes the per unit basis on which this trade related tax, levy or duty is calculated. |

|

|

|

Trade_ Tax. Line Total_ Basis. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value used as the line total basis on which this trade related tax, levy or duty is calculated. |

|

|

|

Trade_ Tax. Allowance Charge_ Basis. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value used as the allowance and charge basis on which this trade related tax, levy or duty is calculated. |

|

|

|

Trade_ Tax. Category. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the category to which this trade related tax, levy or duty applies, such as codes for "Exempt from Tax", "Standard Rate", "Free Export Item - Tax Not Charged" [Reference United Nations Code List (UNCL) 5305]. |

|

|

|

Trade_ Tax. Currency. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the currency for this trade related tax, levy or duty [UNCL 6345]. |

|

|

|

Trade_ Tax. Jurisdiction. Text |

|

O

|

|

|

Restricted codes |

All codes |

|

A jurisdiction, expressed as text, to which this trade related tax, levy or duty applies. |

|

|

|

Trade_ Tax. Customs Duty. Indicator |

|

O

|

|

|

Restricted codes |

All codes |

|

The indication of whether or not this trade related tax, levy or duty is a customs duty. |

|

|

|

Trade_ Tax. Exemption Reason. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

A code specifying a reason for exemption from this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Tax Basis Allowance. Rate |

|

O

|

|

|

Restricted codes |

All codes |

|

The rate of the tax basis allowance (deduction or discount) used to calculate the trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Tax Point. Date |

|

O

|

|

|

Restricted codes |

All codes |

|

The date of the tax point when this trade related tax, levy or duty becomes applicable. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

The type, expressed as text, of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Payment. Identifier |

|

O

|

|

|

Restricted codes |

All codes |

|

The unique identifier of the payment of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Payment Method. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the payment method for this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Deduction. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value of the deduction from this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Self-Assessed Calculated. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value of the self-assessed calculated amount of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Self-Assessed Basis. Quantity |

|

O

|

|

|

Restricted codes |

All codes |

|

The quantity on which this trade related tax, levy or duty has been calculated on a self-assessment basis. |

|

|

|

Trade_ Tax. Self-Assessed Basis. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value of the amount on which this trade related tax, levy or duty has been calculated on a self-assessment basis. |

|

|

|

Trade_ Tax. Regime Type. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying a type of regime applicable to the assessment or calculation of this trade related tax, levy or duty, such as a preferential duty rate. |

|

|

|

Trade_ Tax. Exemption. Indicator |

|

O

|

|

|

Restricted codes |

All codes |

|

The indication of whether or not there is an exemption from this trade tax. |

|

|

|

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the rate for this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Guarantee. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying an undertaking given in cash, bond or as a written guarantee to ensure that an obligation will be fulfilled for this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Guarantee. Text |

|

O

|

|

|

Restricted codes |

All codes |

|

The undertaking, expressed as text, given in cash, bond or as a written guarantee to ensure that an obligation will be fulfilled for this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Tariff Deduction. Quantity |

|

O

|

|

|

Restricted codes |

All codes |

|

A quantity to be deducted from the tariff quantity for the calculation of this trade related tax, duty or levy. |

|

|

|

Trade_ Tax. Refund. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value of the refund of this trade related tax, levy or duty. |

|

|

|

Trade_ Tax. Due Date Type. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying a type of due date for this trade tax. |

|

|

|

Trade_ Tax. Applicable. Percent |

|

O

|

|

|

Restricted codes |

All codes |

|

The percent of trade tax applicable, such as to an object or an activity. |

|

|

|

Trade_ Tax. Rate_ Applicable. Percent |

|

O

|

|

|

Restricted codes |

All codes |

|

The applicable rate, expressed as a percentage, for this trade tax, levy or duty. |

|

|

|

Trade_ Tax. Grand Total. Amount |

|

O

|

|

|

Restricted codes |

All codes |

|

A monetary value of the grand total of the basis plus tax for this trade tax. |

|

|

|

Trade_ Tax. Calculation Method. Code |

|

O

|

|

|

Restricted codes |

All codes |

|

The code specifying the method by which this trade related tax, levy or duty is calculated, such as codes for "tax calculated after line total summation", "tax calculated before line total summation", "tax back calculated based on grand total". |

|

|